Hello, dear readers,

Hello, dear readers,

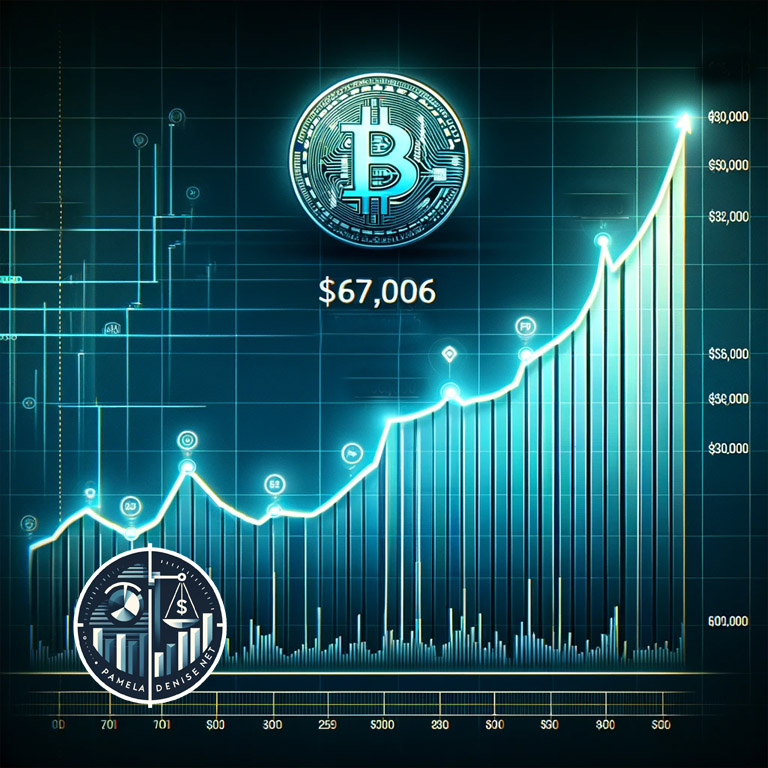

As of today, Bitcoin has surged to $67,006, entering an upper plateau that positions it to potentially retest its all-time high (ATH) and achieve new heights. This significant movement invites a comprehensive analysis, particularly through the lens of the Stock-to-Flow (S2F) model and the broader market dynamics.

Bitcoin’s recent surge can be attributed to a combination of favorable economic data, regulatory developments, and increased institutional interest. The price movement has been robust, pushing past key resistance levels and entering a phase where it might consolidate before attempting to break previous records.

The Stock-to-Flow Model Revisited

The Stock-to-Flow (S2F) model, developed by PlanB, provides a framework to understand Bitcoin’s price movements based on its scarcity. The model’s prediction aligns closely with the current price surge, projecting Bitcoin to potentially exceed its previous ATH of around $69,000. The S2F ratio has increased following the latest halving event, reinforcing Bitcoin’s scarcity and its anticipated price appreciation.

Integrating Dietrich Gottwald’s Theory

Dietrich Gottwald’s theory of the allocation of exhaustible resources offers further insights. By treating Bitcoin as a finite resource, the theory underscores the importance of technological advancements, economic conditions, and regulatory environments in shaping its value. As Bitcoin becomes scarcer and more widely accepted, its price trajectory follows a predictable pattern of increasing value, consistent with both the S2F model and Gottwald’s theory.

Technological and Economic Factors

Technological and Economic Factors

Recent technological advancements in Bitcoin mining and the approval of Bitcoin exchange-traded funds (ETFs) have enhanced market confidence. These developments reduce production costs and improve network security, aligning with Gottwald’s emphasis on technological impact. Concurrently, favorable economic conditions and investor sentiment are driving demand, further supported by a more accommodating regulatory landscape.

Probabilities and Future Predictions

Combining the S2F model and Gottwald’s theory, several key probabilities emerge:

- Price Stability and Growth: Bitcoin is likely to maintain its current upward trajectory, potentially surpassing its ATH.

- Technological Influence: Innovations in mining and blockchain technology will continue to bolster Bitcoin’s market position.

- Regulatory and Market Dynamics: Positive regulatory news and increasing institutional adoption will sustain and amplify demand, driving prices higher.

The convergence of the Stock-to-Flow model, Dietrich Gottwald’s resource allocation theory, and current market dynamics paints a promising picture for Bitcoin. As it stands at $67,006, Bitcoin appears poised to break new ground, fueled by scarcity, technological progress, and favorable economic conditions.

Have a great sunday,

Hugs

Denise

Disclaimer: The author(s) of this article may or may not hold a position in the mentioned stock. None of the companies discussed in the above article have paid for this content. The information provided in this article should not be considered financial advice, and readers should always do their own research before making investment decisions. However, as with any investment, there are potential risks and uncertainties to consider, such as potential regulatory changes, market volatility, and competition from other players in the industry. It is important for investors to carefully monitor this stock and its performance over time to make informed decisions about their investments. PamelaDenise.net is a project of The SiLLC Assembly. This site is for entertainment purposes only. The owner of this site is not an investment advisor, financial planner, nor legal or tax professional and articles here are of an opinion and general nature and should not be relied upon for individual circumstances.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks involves risk, and readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Denise LaVerge is a masterful financial analyst and a co-founder of PamelaDenise.net, where her expertise in financial forensics, valuation, and strategic investment advice shines. With an impressive array of certifications, including Master Analyst in Financial Forensics (MAFF), Certified Valuation Analyst (CVA), Certified Divorce Financial Analyst (CDFA), and Chartered Retirement Planning Counselor (CRPC), Denise brings a wealth of knowledge and a unique perspective to the world of finance and investment.

Her role as an Investment Advisor Representative and a Collaborative Law Financial Expert further underscores her commitment to providing nuanced and ethical financial advice. Denise’s analytical skills are unmatched, allowing her to dissect complex financial data and market trends to uncover actionable insights. Her work is driven by a passion for uncovering the truth behind the numbers, ensuring that her analyses are not only accurate but also deeply informative and relevant to her audience.

At PamelaDenise.net, Denise’s contributions are pivotal in guiding investors through the often turbulent waters of the financial markets. Her ability to translate sophisticated financial concepts into clear, understandable language makes her an invaluable resource for both seasoned investors and those new to the market. Denise’s focus on due diligence and her meticulous approach to research underpin the site’s commitment to providing readers with reliable, up-to-date financial information and analysis.

Her analytical acumen, integrity, and dedication to empowering others with financial knowledge truly set her apart.

Beyond her professional pursuits, Denise is deeply interested in the evolving landscape of financial technology and its potential to revolutionize investment strategies. Her forward-thinking approach to finance is a testament to her belief in the power of innovation to create wealth and foster economic growth.

Through her work at PamelaDenise.net, Denise continues to demystify the complexities of the financial world, offering readers insightful analysis and advice. Her contributions not only reflect her extensive expertise but also her commitment to making financial empowerment accessible to all.